Dealing with air pollution in different countries

- Diana Baizhanova

- Feb 1, 2024

- 4 min read

Key terms

Negative externality of production - negative effect of production on third parties, who are not a part of the transaction, leading to a situation where MSC>MPC

Air pollution - release of the pollutants into the air

Air pollution is a soaring global problem which is present all over the world. It affects population well-being, environment and animals. The sudden rise in pollutants including carbon dioxide, methade, sulfur dioxide and nitrogen dioxide gasses and others led to a significant threat to the well-being of our world. Right now, all of the countries are tackled by the urgent warning which is becoming closer and closer to all of us. The article presented discusses the reasons, challenges faced while dealing with the problem and possible innovative solutions imposed by different countries to help and cope with the problem.

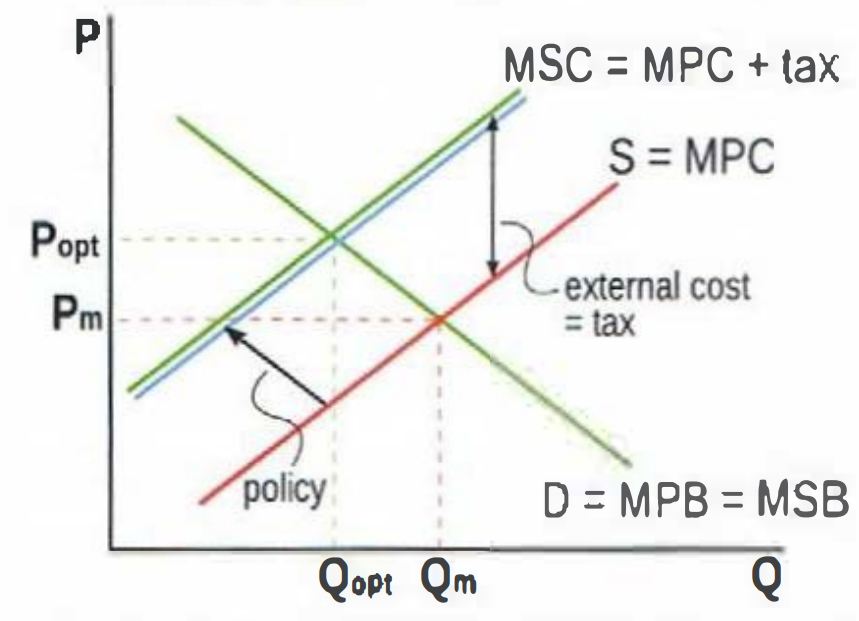

Graph 1: Production of goods, using fossil fuels

On the diagram, there is an optimum market equilibrium, where the MSB curve intersects and is equal to MSC, which shows the socially desired price (Popt) and quantity (Qopt). However, the market can not reach it because of externalities, inefficient allocation of resources, and market failure. There is a market equilibrium on which the market currently consumes, an intersection of the MPB and MPC, with market price (Pm) and quantity (Qm).

MSC is higher than MPC, since producers impose external costs (EC-vertical difference between MPC and MSC) on society, as production of goods using fossil fuels pollutes the air resulting in health problems of the society and other negative externalities. There is a welfare loss resulting from negative production externalities, shown by blue area, that represents the reduction in benefits for society due to the overallocation of resources.

Dealing with air pollution resulting from overproduction of goods using fossil fuels

Carbon tax - tax on ton of carbon emissions:

How does it work?

When tax was introduced, the cost of production increased, making supply less profitable and causing the supply curve to shift from MPC to MPC+tax, causing price to increase from Pm to Popt and Q to fall from Qm to Qopt. Tax is equal to the value of the external cost, thus the externality is internalized, meaning that producers pay for the external cost they create for society, and welfare loss is eliminated.

Is policy effective?

Yes = market-based policy: works using price mechanism and creates incentives for producers to switch to clean energy sources + low cost of implementation + internalizes the externalities

No = hard to implement (calculating value of tax, which is equal to external cost, identifying which pollutants to tax, ensuring enforcement), harm to businesses, since carbon taxes are regressive

Examples:

Finland implemented a tax of 1.12 Euros per ton of CO2 in 1990 and by 1998 CO2 emissions were reduced by 4 million metric tons.

The $2.5 million dollar Biodivercities project is funded by a national carbon tax that came into force in 2017 in Colombia.

Tradable permits - permits to emit pollutants in determined quantity

How do they work?

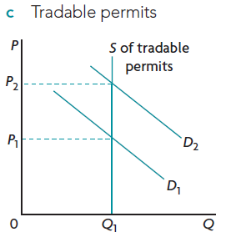

Tradable permits to emit pollutants are distributed to firms by the government, which can be bought and sold in a free market, where price is determined by market equilibrium. Supply is perfectly inelastic as there is a limited amount of permits, but demand might fluctuate depending on the country's economy and ability of firms to reduce emissions, thus price for tradable permits fluctuates as well. Tradable permits make producers use new technologies and ways to emit less pollutants (provide an incentive) and have an opportunity to sell a tradable permit for other firms.

Is policy effective?

Yes = internalizing externality + speeding up the transition to cleaner technologies + determining the exact permissible amount of pollutant in the air + direct incentives for producers

No = challenges related to enforcement + difficulties in determining total permissible amount, distribution among firms

Examples:

The European Union’s Emissions Trading System (EU ETS) is a primary tool in the EU’s strategy to combat climate change.

Legislation/regulation

How does it work?

Legislation and regulations are a command policy, meaning that the government uses its power to enforce laws about air pollution, which citizens must follow. These include licenses, standards, restrictions and permits.

Is policy effective?

Yes = easy to implement, result in faster switch to clean technologies due to obligation of firms to comply with laws

No = cost associated with enforcement, does not create incentives for producers, harm to small businesses, who can not adapt to new standards

Examples:

In the UK, concentrations of key pollutants in outdoor air are regulated by the Air Quality Standards Regulations 2010, the Air Quality Standards (Wales) Regulations 2010, the Air Quality Standards (Northern Ireland) 2010 and the Air Quality Standards (Scotland) Regulations 2010.

China Air Pollution Control Act: Air pollution sources should conform to the regulations and standards shown here. Pollutants from fixed sources may not be emitted without the pollutant discharge license.

International agreements

Air quality has suffered from constant pollution with highly harmful pollutants, leading to health hazards and enhanced greenhouse effect. Air might be classified as a free good and a common pool resource, therefore responsibility lies not only on one country but on the world since consequences of pollution are felt globally. International agreements might be effective since global cooperation is essential to effectively tackle air pollution that transcends borders.

Is policy effective?

Yes = increased scale of policy implementation, country gains help and support from different countries to achieve environmental targets

No = difficult to implement and ensure enforcement

Examples:

UNECE Convention on Long-range Transboundary Air Pollution

Kyoto Protocol

Paris Agreement

To sum up, addressing the negative externality of production, particularly air pollution resulting from the overproduction of goods using fossil fuels, is an urgent global imperative. There are different government economic policies that have a potential in combating air pollution such as carbon tax, tradable permits, legislations/regulations and international agreements. However, they have their disadvantages, but despite them, balance between effective policy implementation and helping to solve difficulties arising for private firms from their implementation should be found to ensure a sustainable and healthier future for society

There are other policies that can be used to address the problem of air pollution, such as advertising, education and awareness creation, subsidizing clean energy and others, however they would be discussed in another article.

Comments